Robber barons of the 19th century 0 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

The mid to late 19th century is best known not for any especially significant market bull runs or collapses, but for the speculative activities, mainly revolving around the railroad stocks, and the individuals who made their money from such activities and became spectacularly rich (and feared) as a result. That they started from humble backgrounds and made it rich on their own efforts (albeit often dubious and ruthless) endeared them to the public. These were the "robber barons".

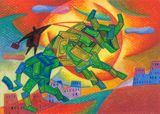

Three men stood out as the most famous operators of their day. Daniel Drew was known as the "Great Bear"; as the name suggested, he operated mostly on the short side. He was known most for his manipulation of the share price of the Erie Railroad, which he was able to exercise control to an extent that is unimaginable today. "Commodore" Vanderbilt was best known as a master of cornering, which is a tactic of squeezing shortists by accumulating the stock available on the market and forcing the shortists to cover. He prevailed over Daniel Drew in the battle of the bull and the bear over the Harlem Railroad in 1862. In his later years, he consolidated a great number of railroads which left a lasting legacy to American industry by improving the efficiency of railroad operations through economies of scale. In this aspect he contributed more to society than Daniel Drew, who essentially saw his companies as vehicles to play the stock market with loaded dice, rather than building up their business operations and boosting fundamental value. Jay Gould was a protege of Daniel Drew, who later forced his mentor out of the Erie board and became its managing director. He was best known for his attempted gold corner in 1869, which was thwarted by the US government releasing a huge amount of gold. Nevertheless, Gould managed to scramble out of the situation with huge profits with skilful covert selling and deceptive stock support by his associates, leaving a massive trail of casualties, which included individual gold speculators and brokers, on a day known later as "Black Friday".

These famous speculators marked an early period in America's stock markets, when stock market regulation was in its infancy stages. Hence the door was open for individuals who spot loopholes in the system to exploit them to the fullest. Unfair use of directorships within a company extended further than insider buying/selling, and corrupted the relationship between directors and shareholders. Daniel Drew, as a director of Erie, often thwarted attempts to corner the company's stock (when he went short on it) by issuing vast quantities of new stock, a practice known as "watering the stock" (interpret it as diluting the value). Some company directors deliberately steered their company into problems which they would publicise, accumulated the stock at low prices, then took steps to solve the problems and drive the stock price recovery.

The success of the pool operators also depended on their being able to suck in unsuspecting speculators to drive the stock up or down, which meant public communications machinery was deployed to disseminate rumours. There were often close relationships between the newspapers and pool operators, and the former were hardly independent reporters of the latter's activities.

This age of speculation was also characterised by federal entanglement in the national web of speculation. The Credit Mobilier scandal in 1872 involved a Member of Congress, Oakes Ames, receiving inflated payments to his personal company, Credit Mobilier, for construction services rendered to the Union Pacific Railroad, which was public listed. Legislative decisions regarding railroad construction and operation permits often went depending on which pool operator's political lobbyists were more effective, and also whether the legislators were themselves vested in the stock.

The next few decades would see the rise of "captains of industry" such as Andrew Carnegie and John Rockefeller who would become more well-known for their contributions to their respective industries of steel and oil, rather than their stock market operations. They represented an improvement in society values, where speculation based on stock market manipulation gave way to a more preferable method of money-making based on building new industries. However, the speculative spirit would always exist in the blood of humans, and many would think back fondly of the robber baron days with their no-holds-barred operations.

References:

(1) Devil Take the Hindmost (by Edward Chancellor)

0 Comments:

Post a Comment

<< Home