The 1985 Pan-Electric crisis 2 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Small investors have been "entertained" by a deluge of corporate scandals such as CAO, Citiraya and ACCS over the past one year, leaving them wondering where the next one will come from. Veteran investors will view this in context; to them these are nothing new as the stock market is inherently about assuming risk; they will point to the Pan-Electric crisis in 1985 as an example where the SGX was caught in a greater bind, causing it to suspend trading for 3 days. This was the only time in its history since then that it did so.

The 1985 collapse of Pan-Electric was as sudden as it was catastrophic. Financing its operations with a series of forward contracts (will be explained later) that brought it into heavy debt (S$450M debt vs market cap of S$230M) which it had trouble refinancing during the 1985 economic recession in Singapore, its financial insolvency were exposed by underwriters during a proposed rights issue. The rights issue was cancelled, Pan-El trading was suspended, a rescue package planned and aborted, all stock trading on the SGX was suspended; this chronological series of events happened within the space of half a month from mid- to end-November 1985, at the end of which Pan-El went into receivership and was ultimately wound up in 1986.

Investors in the stock would have their individual hard-luck stories, all 5,500 of them who ended up with nothing, but the biggest loser in the fiasco was the man at the centre of the storm: Tan Koon Swan, a substantial shareholder of the company holding an indirect 30% stake, and the most well-known Chinese politician in Malaysia, as newly-elected President of the Malaysian Chinese Association (MCA). Exercising tremendous influence over Pan-El's directors in the entering into of forward contracts that were to bring the company to dire straits in 1985, he was later found guilty oif and jailed for attempting illegal funds transfers from various sources, including from Multi-Purpose Holdings, the commercial arm of the MCA, during the Pan-El crisis period in 1985 in his vain attempt to raise capital to rescue the company from insolvency. A witch-hunt always follows a debacle, that much is certain; and in this case it brought an end to both Tan's business and political careers.

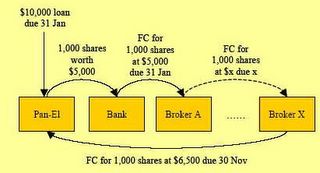

It is also important to highlight the impact that the Pan-El collapse had on the financial system which caused the SGX to take such a drastic step as to suspend all stock trading for 3 days. The forward contracts that Pan-El entered into implicated a whole food-chain of banks and brokers. An MAS paper summarised it well: "With forward trading, a whole chain of parties is linked via promises of sale and purchase to the same lot of stock, the line only ending with a purchaser which either wants to keep the stock, or that cannot find someone else to sell it to. If this last purchaser is unable to meet its obligations to pay for the stock when they fall due, a domino effect is created and defaults could occur down the chain."

For example, if Pan-El wanted to loan $10,000 from a bank, it would pledge say, 1,000 shares worth $5,000 as collateral. The bank would enter into a forward contract with a broker A to sell the shares to this broker at a certain (higher) price at a specified future date. Broker A would then enter into another forward contract with Broker B to sell these at a yet higher price in the future, and so on up to Broker X. Pan-El would then subsequently close the loop some time later by purchasing the last forward contract from Broker X at say, $6,500; the entire value chain would have augmented their profit by $1,500 while Pan-El would have obtained cheap financing through such a system of arrangements.

A win-win situation, which unfortunately unravelled in bear markets when Pan-El had difficulty getting new loans to finance its re-purchasing of such forward contracts. This meant Broker X would not even get its capital back, and thus could not repay Broker W, who could not repay Broker V, and so on up to Broker A and the lending bank.

It was this series of inter-linkages which dragged six brokerages to their demise together with Pan-El, and caused a crisis of confidence that caused the markets to plunge when the SGX re-opened in December 1985 after 3 days of closure (a day known as "Black Thursday" in the local context). It created impetus for stricter regulation of the SGX by MAS from then on. The market changed from a self-regulated entity to a tightly-regulated one, in particular with regard to brokerage capital requirements, gearing and margin limits, as well as reserve fund requirements. This has since loosened to a disclosure-based regime, where the onus is on the individual investor to exercise caveat emptor.

References:

(1) MAS Paper on the Pan-El crisis

(1) Lessons: The debacle of Pan-Electric Industries (by Kevin Sullivan), from Asian Entrepreneur Sep 2000 issue

2 Comments:

see, you working hard on your blogs. good luck

Thanks for sharing this most usable article. I have accounting software that means cleanbooks is an accounting website of Singapore that keeps your Account Books clean and lets you give attention to on your Business. We provide to latest information about the Singapore stocks.

Post a Comment

<< Home