The early-1990s Singapore residential property boom 24 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Nowadays, not a day passes without the papers reporting bullish news of prospective property deals; some argue that the residential property market is in the beginning of a new secular boom that could spread to the lower-end housing markets while others are significantly more cautious and cynical. In both camps the comparison is inevitably done with the property bull market of the early 1990s, when this asset class reached speculative heights and ultimately became a bubble that was pricked by consecutive blows of government regulatory measures and regional political trouble.

The fundamental case for property investing in the early 1990s was predicated on the rise of Singapore domestic demand. With economic stability and increased purchasing power built up over preceding years, it was time for asset enhancement in the 1990s. Young Singaporeans were being urged to marry and population control and immigration policies were being revised, adding to the demand for housing. Households were becoming increasingly double-income, increasing the purchasing power for big-ticket items. CPF balances were rising in-step with incomes, providing the financing means for purchasing expensive private property.

The sentimental case for property investing had been built up over the years. Since independence, the government had been promoting home ownership as a crucial tenet of nation building, and a huge majority of Singaporeans (~80-90%) owned the apartments they stayed in (mainly HDB). Hence increasingly over the years, property was seen as a good investment as prices were well-supported by the abovementioned government stand towards home ownership, the scarcity nature of Singapore property (the supply side), and perceived continued economic growth and stability (the demand side). Demand also trended towards more expensive private housing as people strove to upgrade their lifestyles. Many fellow Singaporeans will remember the Singapore dream built on the material five Cs: career/cash, credit cards, car, condominium, country club membership. Hence snob appeal and social aspirations accounted for an additional component of property demand meant for consumption.

Property as a comparative investing instrument was superior to other asset classes. There were few avenues for the less-educated to put their money: bonds had never been an Asian mass-market instrument, there was mass distrust of stocks due to their volatility (the market had shot up in 1993 and then dived back down in 1994), and money deposit rates were low. This also meant that housing loan rates were low (6% or less) and hence money was cheap. The unique standing of property as the only main investment instrument that could draw on the bulk of CPF funds enhanced its appeal; people tended not to think of it as "real money".

Given the above factors, property purchasing for consumption and investment soon turned into speculative buying. Stories of people buying an apartment for $500,000 and selling it for $700,000 a year later were part of the popular folklore. One apt description was that "people are buying property like groceries". This, of course, refers to the particular segment of property sales known as sub-sales, where people buy a property and then sell it off even before completion --- the most direct measure of speculative activity. At the height of the mania in the mid-1990s, there were the much-publicised midnight queues preceding condominium launches and the peaking of the highly reliable contrarian index known as the "market/coffeeshop auntie/uncle - buying, selling and recommending property" indicator.

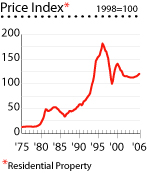

All segments of the residential market were booming, including newbuilds, resales, public (HDB) and private housing (condominiums). From 1986 to 1996, the private residential price index rose by about 440%. About two-thirds of this gain was in the early 1990s up to 1996. See below for a graphical representation. There was a big merry-go-round as sellers became buyers of other properties, whose sellers then sourced for new residences. Over 1992-2002, 58% of the 3-million population changed homes. Among private homeowners, it was almost 70%. This created an upward spiral of property prices that was exacerbated by the speculative elements.

In 1996 the government introduced regulations to cool property speculation, which included heavy taxes on profits made from property sold within three years of purchase --- a measure targeted at property speculators. It had to end somewhere. Rocketing property prices were increasing the costs of living, driving some citizens out of Singapore and decreasing its long-term business competitiveness. The private residential property market prices collapsed; the end of the bull market was confirmed by the 1997-98 Asian financial crisis that destroyed foreign demand drivers from the ASEAN region. With the exception of a minor mini-rally in 2000, private housing prices had dropped 30-40% by 2003, since they peaked in 2Q96. The HDB resales market was better although it was never to reach the heights of 1996, primarily because the government was careful about its impact on ordinary, less well-off Singaporeans.

Still, the damage had been done. The term "negative equity" is used to describe a situation where the difference of the investment's market value and the debt incurred in financing it is negative --- a predicament that many Singaporeans have been stuck in. The plunge in residential-property prices also had an impact on private consumption - fewer owners were able to withdraw equity from their homes to borrow against the increase in value to finance other consumption. As a result of heavy investments in property, Singaporeans are asset-rich and cash-poor, even counting their CPF retirement money. It is an example of how investments based on solid fundamentals can turn into speculative buying egged on by peer pressure to "make money while it lasts"; when the primary driver is sentiment and liquidity rather than fundamentals, it can be prone to sudden drying of liquidity that causes prices to plunge. In this case, the reversing of government policy towards controlling asset inflation just happened to be the catalyst that caused the U-turning of residential property prices. Even if it had not taken place, the hit would still have been suffered in the 1997 Asian financial crisis. It was a disaster to happen, and as always, it was one that was precipitated by human envy and greed, in my view.

References:

(1) Global Property Guide: Singapore

(2) The Star, May 2002: Curbing the property craze

(3) Asia Inc, Nov 1993: The Boredom Bubble

(4) Asiaweek, 1996: Testing Times

(5) FEER, Jul 2003: Singapore's housing glut

24 Comments:

Welcome to TheGazania, TheGazania is one of the best platforms for property investment in Singapore. We provide low rise freehold condo for sale in Singapore. Find the best freehold condo for sale near MRT in Singapore condo for sale Singapore

Welcome to TheGazania, TheGazania is one of the best platforms for property investment in Singapore. We provide low rise freehold condo for sale in Singapore. Find the best freehold condo for sale near MRT in Singapore condo near mrt

low rise condo Singapore

Welcome to TheGazania, TheGazania is one of the best platforms for property investment in Singapore. We provide low rise freehold condo for sale in Singapore. Find the best freehold condo for sale near MRT in Singapore

In order to get best deals on property for sale singapore make sure to read latest property news on Property Asia Direct.

This comment has been removed by the author.

Hello everyone are you a forex trader or you Have heard about it for long and right now you wish to give it a trial ? please also be careful of these unregulated brokers advertising on the internet.

You can avoid loses and also make good choices when choosing a broker to trade with.

So i am recommending an expert who is well known all over EUROPE & AMERICA for her master class strategies and trading techniques which includes her ability to recover loses no matter how long it must have been, she also gives free tutors for beginners.

I share this because she has led me and so many other people away from the paths of failure , into success for over 3 years now that I have known her and

I'm making huge amounts of money through profits.

To reach out to Mrs Deja Ellie is very easy and she is ready to take up the challenges with you.

All you have to do is drop a mail to her email address -( Dejaellie@gmail.com ) - the doors are always open to reach out to her..

thank you.

Be safe

Hi guys, if you have been a victim of any binary/ cryptocurrency scam, contact easybinarysolutions@gmail.com they're highly recommendable, and were efficient in getting my initially lost 2btc refunded.

Thank you so much for sharing this great blog.Very inspiring and helpful too.Hope you continue to share more of your ideas.

want to get an exclusive condo in Singapore at a reasonable price? you have a choice for both on rent or buy, according to your needs. The M Condooffers residents a condo with a host of amenities that include swimming pools, tennis, and many more facilities.

We Offers Financial Consulting To Client, Companies Seeking Debt / Loan Financing And Seeking For Working Capital To Start A New Business Or To Expand Existing Business. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

Do You Need A Loan To Consolidate Your Debt At 1.0%? Or A Personal Loans * Business Loans etc. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

We Have Loan Programs Tailored For Any Profile And You've Come To The Right Place To Satisfy Your Business Needs. If Your Company Or You Know Of Any Company With Viable Projects / Proposals That Needs Financing, Kindly Write Us With The Loan Requirement. Please, Contact Us For More Information: inforamzanloan@gmail.com

Do You Need A Loan To Consolidate Your Debt At 1.0%? Or A Personal Loans * Business Loans etc. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

We Offers Financial Consulting To Client, Companies Seeking Debt / Loan Financing And Seeking For Working Capital To Start A New Business Or To Expand Existing Business. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

Kindly write us back with the loan information;

- Complete Name:

- Loan amount needed:

- Loan Duration:

- Purpose of loan:

- City / Country:

- Telephone:

- How Did You Hear About Us:

Do You Need A Loan To Consolidate Your Debt At 1.0%? Or A Personal Loans * Business Loans etc. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

We Offers Financial Consulting To Client, Companies Seeking Debt / Loan Financing And Seeking For Working Capital To Start A New Business Or To Expand Existing Business. Interested Parties Should Contact Us For More Information Through Via E-mail: inforamzanloan@gmail.com

Luxury Home Singapore was introduced as a platform site for choosing Singapore 's finest luxury properties and high-end dollar homes

To know more about luxury property please click below links

luxury condominium singapore & singapore luxury apartments for sale

Your blog is very nice and informative. We are offering residential flats in Realtor patrick singapore in the budget.

Your blog is very nice and informative. We are offering residential flats in Realtor patrick singapore in the budget.

Are you looking for a comfortable and top model or style flats in Singapore? No need to worry!! visit our online website Treasures At Tampines, and get flat-top model or latest design or condo according to your need.

Thanks For delivering this amazing post. I have come across the best platform to sell my house in the United States. It is none other then RealEstateCake.

https://www.blogger.com/comment.g?blogID=715613408659951125&postID=982182155922554111&page=1&token=1599464992996&isPopup=true

Leedon Green Review - A New Singapore Condo

If you are discovering luxury flats in your budget or dream city Singapore? No worry!! Good news for all who want to buy a flat or condo. Leedon Green Review is the right option for you. It is a new launch condo in Singapore. You can buy your dream home at the most competitive price

leedon green

leedon green condo

leedon green price

leedon green showflat

Treasure At Tampines psf - A New Singapore Condo

If you are discovering luxury flats in your budget or dream city Singapore? No worry!! Good news for all who want to buy a flat or condo. Treasure At Tampines psf is the right option for you. It is a new launch condo in Singapore. You can buy your dream home at the most competitive price

Treasure At Tampines

Treasures At Tampines

Treasure At Tampines Review

Treasure At Tampines Top

Do you need 100% Loan Finance? huge capital Private finance for business expansion, new project start up. We offer our services to both government and companies in any part of the globe. Our services falls in various ranges like direct funding program, short and long term funding program, Discounting of bank Financial Instruments, Letter of Credit against acceptable bank instruments, Asset trading – Trade finance Etc.

AHMED KUMAR.

solutionlogicmoney@gmail.com

Whatsapp Number: +447459797459

Whatsapp Number: +918375004762

LOGIC MONEY FINANCIAL COMPANY

URGENT LOAN! URGENT LOAN!! URGENT LOAN!!!

Are you in need of urgent financial assistance for a personal purpose or for your business needs? Here is some good news for you. We offer loans to individuals or corporate firms at the lowest annual percentage rate 2%.

Contact us today to get:-

*Car Loans

*Business Loan

*Debt Consolidation Loan

*Personal Loan

*Business Expansion Loan

*Student Loan

*Agricultural Development Loan

And Lots more.

Contact us today Via (Expressglobal55@gmail.com) or (+12606355412)

Thanks.

Helpful Information delivered by this post. Now calculate your rebate with our Rebate Calculator because on booking home builder with Get New Home Rebate Realty you will be rewarded with Flat 2% new home rebate.

EASY LOAN PROGRAM

During these uncertain economic times, many people are finding themselves faced with a situation where they could use some financial assistance. Whether it be for an emergency, home improvement, consolidating debt or even a family vacation – a low interest personal loan is a safe and reliable way to meet your financial needs. At Alta Finance LLC, we specialize in Reliable and efficient Loan funding programs.

Kindly visit our website to know more about our services www.altafinance.org

Contact me via my personal email to know more about our lending process

Email: robertraymond@altafinance.org

Whatsapp: +17026022533

Thank you.

GENUINE BANK GUARANTEE (BG) AND STANDBY LETTER OF CREDIT (SBLC) FOR BUY OR LEASE AT THE BEST AVAILABLE RATES

We offer certified and verifiable financial bank instruments via Swift Transmission from a genuine provider capable

of taking up time bound transactions.

FOR LEASING OF BG/SBLC

MINIMUM FACE VALUE OF BG/SBLC = EUR/USD 1M

LEASING FEE = 4%+2%

FOR PURCHASE OF FRESH CUT BG/SBLC

MINIMUM FACE VALUE OF BG/SBLC = EUR/USD 1M

PRICE = 32%+2%

Our BG/SBLC Financing can help you get your project funded,

loan financing by providing you with yearly.

RWA ready to close leasing with any interested client in few banking days

I will be glad to share with you our working procedures.

Name : scott james

Email : inquiry.securedfunding@gmail.com

Skype : inquiry.securedfunding@gmail.com

Thanks for sharing this post please visit our site for more information...New launch property in singapore

Properties for sale in Singapore

Thanks for sharing such information - please look

Discover a modern, well-connected home with Christie’s International Real Estate. With flawless MRT access, top-tier amenities, and lush green surroundings, this is where convenience meets luxury. Find your dream home with the most comprehensive Properties for sale in Singapore, discover high-rise properties like HDB, condo and apartment as well as landed property for sale in Singapore.

https://www.ciresg.com/properties

Post a Comment

<< Home